|

>>> Compare Medicare Supplement Plans Now >>>>>>

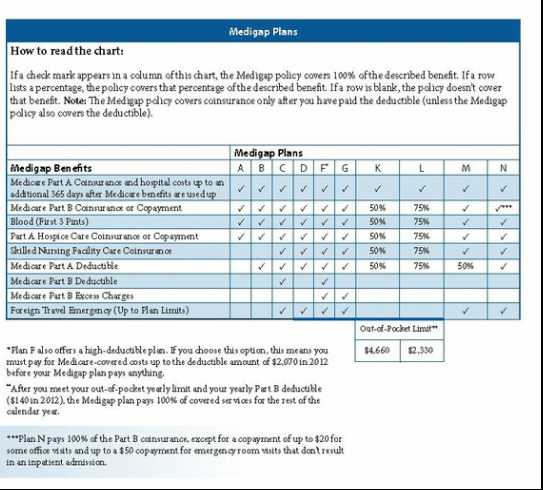

Medigap (Medicare Supplement Insurance) Policies From the 2014 Medicare and You Handbook: Original Medicare pays for many, but not all, health care services and supplies. A Medigap policy, sold by private insurance companies, can help pay some of the health care costs (“gaps”) that Original Medicare doesn’t cover, like co-payments, coinsurance, and deductibles. Some Medigap policies also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then your Medigap policy pays its share. Medicare doesn’t pay any of the premiums for a Medigap policy.</blockquote> Every Medigap policy must follow Federal and state laws designed to protect you, and it must be clearly identified as “Medicare Supplement Insurance.” Medigap insurance companies can sell you only a “standardized” Medigap policy identified in most states by letters. All plans offer the same basic benefits but some offer additional benefits, so you can choose which one meets your needs. While there are numerous Medicare Supplement plans available, there are four that we specifically recommend. Because all plan types are strictly regulated, we believe you should only purchase a plan with benefits that match the value for your premium dollar. The four plans we recommend as well as highlights of each plan's coverage limits are listed below: Medicare Supplement Plan F Medicare Supplement Plan G Medicare Supplement Plan M Medicare Supplement Plan N |

We never share your information with anyone outside of our agency for any reason. We respect your privacy.

|

_

More from the 2014 Medicare and You Guide:

Insurance companies may charge different premiums for exactly the same Medigap coverage. As you shop for a Medigap policy, be sure you’re comparing the same Medigap policy (for example, compare Plan F from one company with Plan F from another company).

The types of Medigap Plans that you can buy changed 3 years ago:

■ There are two new Medigap Plans—Plans M and N.

■ Plans E, H, I, and J are no longer available to buy. If you bought Plan E, H, I, or J before June 1, 2010, you can keep that plan. Contact your plan for more information.

More from the 2014 Medicare and You Guide:

Insurance companies may charge different premiums for exactly the same Medigap coverage. As you shop for a Medigap policy, be sure you’re comparing the same Medigap policy (for example, compare Plan F from one company with Plan F from another company).

The types of Medigap Plans that you can buy changed 3 years ago:

■ There are two new Medigap Plans—Plans M and N.

■ Plans E, H, I, and J are no longer available to buy. If you bought Plan E, H, I, or J before June 1, 2010, you can keep that plan. Contact your plan for more information.